Investing in Cryptocurrency can give you a huge return on investment. Whether you have a little investment or a big cash deal, you can earn from it by making a smart decision. One thing you must know that investing in cryptocurrency isn’t easy, it also associates some risk. Let us discuss some of the pros and cons associated with investing in cryptocurrency, you must know about the rewards and risk associated with these investments. So let’s start to better understand this concept.

Investment in cryptocurrencies has shown massive growth in recent times. Today many people have moved to make the investment and are hoping for a bright future for Bitcoins and other crypto, and it is grabbing people’s attention day after day, and many economic analysts even have made predictions about rise in the rate of Bitcoins in the future.

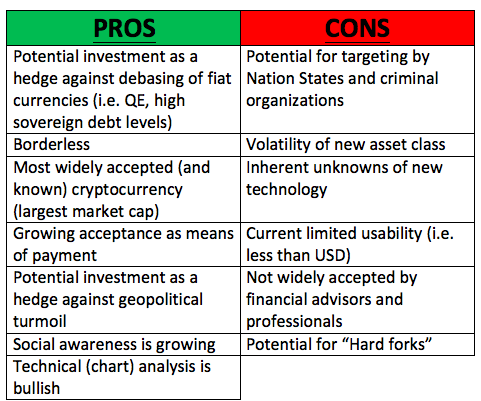

PROs

- People are quite optimistic about the future of the cryptocurrencies market and consider it young as the Bitcoin price now ranges in thousands of dollar per Coin on exchanging.

- Due to the high volatility of cryptocurrencies more investors are jumping into the market and it is growing day by day.

- As an economic point of view due to the stagnation in the Securities market the value of currencies such as Bitcoin and investment in them is likely to see the rise.

- Cryptocurrencies have gained their value by making use of the technology and are likely to increase with use of relevant tech and fields.

- Cryptocurrency has their own value as dollars and in some inflation torned nations they have become essential as other currencies.

- There are so many ways to earn from cyptocurrency.

- You don’t even need to have use any software to get into cryptocurrency world, with so many web wallets, the conventional barriers to entry to financial world is zero. Financial accounts are no more issue like in the past, now the people can just visit a website and start accepting crypto than travelling to and waiting in Bank queues to get started

CONs

-

- The popular currencies especially cryptocurrencies are economic fizz, and in such a situation when the assets are overestimated it can increase the prices by conjectures. And many experts even don’t think of overvaluing of these assets.

- Cryptocurrency ICOs have a volatile issue as the hacking incidents often occur to investors and they lost their investment quickly.

- If we think of some other currencies as the highest-valued cryptocurrency, like Bitcoin or it will be the next currency, then it should be kept in mind that not all the coins will be much profitable even if they are all ready for purchase.

- The cryptocurrency sometimes fails to attract more users for selling their product as a network engagement, as the people sometimes didn’t make use of currency and its value can fall.

- ICO projects needs a clear set of a team to run development phase for a solid foundation. While making an investment in cryptocurrency ICO, one must evaluate the team’s skills, and abilities are enough to execute such projects. So there needs clearance in the process for transparent you can do nothing with cash as there are no records on it.

Summary

The decentralized cryptocurrencies nature makes it more reachable to worldwide. Now people have access to the financial independence even across the orders as they can invest freely. Cryptocurrency has their own value as dollars. People also know how they can earn with cryptocurrency, but while spending you must think of risk and prepared your mind for it.

Great information. Lucky me I recently found your site by accident (stumbleupon).

I’ve bookmarked it for later!

Hi there, I check your new stuff daily. Your story-telling style is awesome, keep up

the good work!