Trading in Cryptocurrency includes trading the coins ranging from Bitcoin, Ethereum (ETH), to altcoins. Each of these coins is unique and have different functionalities. Similar to the risks involved with the investments done in stock markets, these cryptocurrencies too have risks associated with them, the market is quite volatile. Trading in cryptocurrency is the process of taking advantage of this volatility, by selecting the best strategy, following it and sticking to the best plan.

How it differs from Stockmarket-

Now let’s see how trading in cryptocurrency is different from trading in sharemarkets. there is

Exposure mostly unconditional to insider trading along with pump and dump schemes

-

In the stockmarket, the insiders have the unfair advantage as compared to outsiders, as these outsiders don’t have access to the details discussed in board meetings, etc. So to reduce this inequality between insiders and outsiders, there are strict laws to protect the interest of the outsiders. At the same time, in cryptocurrencies, however, there are no laws protecting outsiders.

-

Most of the cryptocurrency exchanges do not conduct any identity verification which further makes it difficult to track and punish the culprits behind all these unfair trading activities. Not just that, these exchanges don’t report any illegal activity to government, so it makes it difficult for the government to take any actions.

-

The lack of deposit or security insurance -If you buy stocks at any U.S. broker-dealer, both your cash and stocks are insured to a certain limit. So, even if due to some problem your brokerage ever goes out of the track to lose, Authorities would take care of the reimbursements. Cryptocurrency exchanges, on the other hand, do not provide either cash or asset insurance except a very few. In case of any loss, there will be no government protection as these cryptocurrencies are not even treated as legal. Vigilance in the financial health and integrity of all their exchanges is thereby essential for cryptocurrency exchanges.

-

The risk of permanent loss- If the hackers could manage to steal private keys by breaching into your cryptocurrency exchange, then money is lost. Since cryptocurrency transactions are irreversible, this loss will be permanent, and nobody will be able to help you. You can’t sue the exchange too as it’s not their fault/ deed.

-

Price inconsistency across exchanges & order protection no regularization- With stocks, you are safeguarded by the authorities that the orders aren’t filled at a worse price than the one best offered. On the other hand, with cryptocurrencies, the best bid offer is all over the place, and exchanges have no legal obligation to match the price or to improve it.

-

Pump and dump: These are certain mechanisms observed in cryptocurrency unlike stock markets. Here, before this ‘pump’ comes to action, there is this pre-pump stage wherein a few people plan to pump a coin and they buy bulk amounts of this coin at low rates. These same people would effectively market this particular coin via various social media or groups and create a fake demand and then sell off these coins at a very high price. Post pump, there is this ‘dump’ stage while the buyer’s purchase, the price would crash thereby causing a final ‘dump’, leaving all those coins with the new buyers.

-

Whales, these are a group of people who are ‘big players’ in this market, who hold a large number of coins or those people who are capable of manipulating the market using their assets. It is very crucial for small players to pay attention and make proper judgments by analyzing the trends in the cryptocurrency market.

3) Still why People Trade in Crypto

Despite these pitfalls people keep trading in cryptocurrency- The exchanges are vulnerable to be hacked, but people continue to trade in crypto. This is because of the high return on investment. Added, it doesn’t take ages to construct a portfolio and high returns or profit can be made by just observing and analyzing the trends in the market. High profits are made with comparatively lower investments and a shorter time, So this is the main feature that is appealing in spite of all these pitfalls.

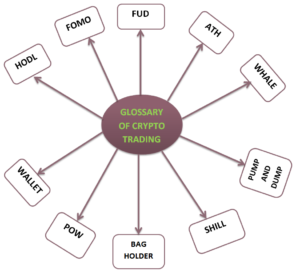

4) Glossary of Crypto Trading

HODL-It is a misspelling of ‘hold’ whose full form is Hold On for Dear Life. It’s a state of mind when you buy coins, but then you don’t see a nearby future to sell it.

FOMO-This is an acronym for ‘fear of missing out.’ This is that feeling or state of mind when, there is this coin which you want to buy, so you buy it by selling other coins you have. Swing trading while being done, this FOMO has to be taken into account.

FUD-It is a Short form of ‘fear, uncertainty, and doubts.’ When the news about ‘bitcoin is all fake’ come up, this state of mind is induced.

ATH-It is a Short form for “All-Time High.” It is the highest price of a particular coin ever.

Whale-A whale is referred to a tremendous player who holds a significant amount of capital.

Pump and Dump-The repeating cycle where after a spike there is a massive crash.

Shill-Unrequested endorsement of a coin in public. The traders who bought a particular coin will try driving the public interest to it.

Bag Holder-a term used to describe the holder of a coin who bought it when the demand was high but then he had lost his chance to sell the same, leaving those with less value

PoW-An acronym for Proof-of-work. It is the current consensus algorithm used by Ethereum.

wallet-It is a Storage for crypto-currency which exists mainly as various software files on a computer.