6)What you need to Know before you Start Trading

A)Pump Dump Groups-

There are certain groups in various platforms like telegram or other sites, wherein they create a pump by speculating a hike in demand for certain coins at a specific time. Some of the buyers attain a profit, while others end up low valued coins bought at an inflated price or the coins that were get ridden off by the whales for a high value. You need to be informed that when these groups are buying, so you may keep at bay during that time, and sell when they are pumping, so gather action info of such groups so you don’t buy a pumped up coin in action, as you are in just bad luck.

“ You need to be in selling Mode when Pumpers are Pumping Up Coin”

Now let’s know something about whales and pump dump

These groups are of three type-

1) Daily Pump Groups-These are group of small sizes, with small volume on any one exchange with their pumping volume capacity up to some BTC, They do pumps of coins like daily etc, their Pumping lasts only minutes as most of these persons are normal persons who start selling when coin get some 10% jump , their action lasts for only some minutes and most of these group members lose money or got stuck with high-value coin who they hold since they don’t wanna sell it at low now. Admin of these groups are the only money makers or some early buyer members of the group. If you want some instant 10-20% profit sell when they buy. They choose coins with low volume to pump which is a bad thing in itself for buyers.

2) Baby whales- These people have enough short-term volume on many exchanges in ranges of hundred of BTC, they can raise the value of coins in a short period( from days to a week) by buying and buying of coin, when price has jumped enough around 50-100%, they sell. In this type of Pump, all can make profit by selling intelligently.

3) Matured Whales-These people are matured and high-risk takers, they don’t go for some % of profit , they double, triple their money in a pump, they pump up market for a long time with large volume and burst of buying , this pumping period can be from weeks to months, when these pump bullish trend starts , and if you buy early its good days ahead. Its safe and profitable to follow these guys but they are not telling their plan.

So now we all know to steer clear of daily pump groups or only sell when they buy, with baby whales sell also, but with matured whales buy early or sell after.

B)Technical Analysis-

For the new investors who have just started trading in crypto, the strategy is all about buying a few coins and holding them up till a profit pops in and selling them. Even though it sounds easy, it would affect your trade negatively if you buy coins at the wrong time. This ought to happen spontaneously and will give you a wrong start if you don’t do the technical analysis of the best time to buy or sell. .Technical analysis would reduce your risks and help you trade better. If you critically observe, you would find the prices irrational but if observed for a long period they ought to have a rational behavior. If this technical analysis is done, you will follow a price pattern that would assist you in taking major decisions.

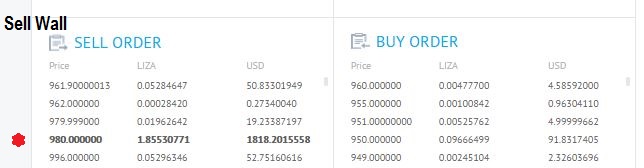

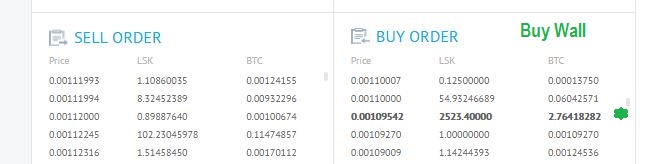

C)Buy Sell Walls –

Huge players manipulate prices by employing the buy and sell walls. A sell wall is basically a large amount of coin on sell of the coins so that these whales can buy these coins at low prices. There would be huge buy and sell orders only if the markets are set to be manipulated/Trend Change. These walls denote Support/Resistance. This reveals the presence of coins available to trade at high volume. Buy/Sell walls are used to create favourable sentiment in other traders. Let’s suppose there is a 1000BTC buy wall in a coin with daily volume of 20-50 btc, All other Traders will see it and thinking its very strong resistance, they will put their order just above it, and so price will soon start rising, same goes for Sell wall. So a Big player can change trend if there is just no news/event, so keep a watch on such.

Why People Put Up a Sell Wall in Crypto?

- To Hold or Suppress a Price.

- Push Price Down to fill Personal Buy Orders.

- To Cause sudden Panic.

- Because Everyone Wants to Sell.

- Also to Create a Negative Sentiment in the Market regarding the token.

Why People Put Up a Buy Wall in Crypto?

- Sellers are made to Close Their Sell Orders.

- Push the Market Up.

- Push the Market to fill Personal Sell Orders.

- Create a Positive Sentiment of the token in the Market.

Buy/Sell walls can be manipulated they break more often than provide support, so don’t just believe it, a Trader might be just playing and deceiving you by using them. So cross check Buy/Sell wall at many exchanges

D) Events and development driven price in cryptocurrency-

there are specific events and developments that would drive up the price of a token. Fundamental analysis has to be done to find the value of a token. This analyses the evaluation of economic, financial and several other fundamental key variables to calculate the true price of a security. Positive media coverage also creates change in investor’s decisions. The various announcements based on the cryptocurrencies are some other events that have huge effect on the prices.

7) How to Make Profit in this Crypto Market-

-

Be in regular touch with pump-dump groups via several mediums like the telegram. This would get you to know who is buying what, using this method you can sell while they are buying when the pump is over, and when you find that the price has come back normal, you can buy again with some profit in hand.

-

It is always better to Buy When the crypto market is bullish ( a market is said to be bullish if the prices are in rise or it is expected to rise, and if any significant currency is staying idle for a long time there are huge chances pumpers can target it.

-

If you notice any exponential growth in a particular token without any news or event, this can be a signal to exit out.

-

Trading with market FOMO or condition of panic sell- This FOMO is considered to be a barrier for trading as it undermines the confidence by creating anxiety for traders. Try Understanding the market structure, why and how prices move and know how to trade at those price movements, make a trading plan and automate the same. Panic selling refers to the large-scale selling of tokens which causes a decline in price. Most of the cases, these traders want to get rid of the tokens with less emphasis on the price.