1.ETF Filed With SEC to Invest in Bitcoin Futures, Bonds, and Mutual Funds

2.Crypto Broker Voyager Goes Public on the Toronto Venture Exchange

1.ETF Filed With SEC to Invest in Bitcoin Futures, Bonds, and Mutual Funds

A registration statement for a new exchange-traded fund (ETF) that will invest in bitcoin futures among other traditional investments has been filed with the U.S. Securities and Exchange Commission (SEC). The fund’s portfolio will include bitcoin futures traded on the Cboe Futures Exchange and the Chicago Mercantile Exchange as well as sovereign debts and money market mutual funds.

Reality Shares ETF Trust filed a registration statement with the U.S. Securities and Exchange Commission on Monday for an ETF that will invest in bitcoin futures as part of its investment strategies. The Reality Shares Block force Global Currency Strategy ETF will be an actively managed fund listed on the NYSE Arca exchange. The fund is “designed to provide investment exposure to global currencies, both fiat and virtual currencies,” its filing reads.

The new proposed ETF will invest in a portfolio comprised of “high-quality, short-term (no greater than 18-month maturity), sovereign debt instruments” listed for trading on U.S. exchanges in U.S. dollars, euros, British pounds, Japanese yen, and Swiss francs. According to the filing, it will also invest in “bitcoin futures contracts of various maturities listed for trading on U.S. exchanges that provide exposure to the price movements of bitcoin” as well as “money market mutual funds and/or other cash equivalents.”

Investing in Bitcoin Futures

The registration statement for the Reality Shares Blockforce Global Currency Strategy ETF details:

“The fund plans to invest in the bitcoin futures traded on the Cboe Futures Exchange Llc … and/or the Chicago Mercantile Exchange (CME) but may invest in bitcoin futures traded on other exchanges in the future.”

The former was incepted on Jan. 17 last year and seeks long-term growth by tracking the investment returns of the Reality Shares Nasdaq Blockchain Economy Index. The latter was incepted on June 20 last year and seeks long-term growth by tracking the investment returns of the Reality Shares Nasdaq Blockchain China Index comprised of blockchain-related companies located in Hong Kong and mainland China.

2.Crypto Broker Voyager Goes Public on the Toronto Venture Exchange

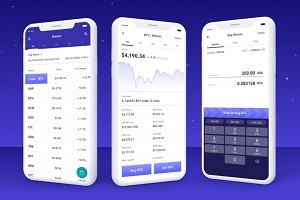

Voyager Digital, a business that provides retail and institutional investors with cryptocurrency trading solutions, has officially been listed on the Toronto Venture Exchange (TSX.V) under the symbol VYGR.V.

Voyager isn’t the first crypto firm to list on the TSX Venture Exchange to increase exposure. Mike Novogratz’s cryptocurrency focused merchant bank, Galaxy Digital, listed last August. Since that time, the share price has fallen roughly 29% as the company continues to struggle with operating losses.

Moving forward, Voyager plans to leverage the new shares and capital to further expand its offerings and grow the company. According to Ehrlich, Voyager is “now actively looking for parts of the crypto ecosystem that fit with our mission and our culture.”