Bitcoin (BTC) $ 105,921.00 1.15%

Bitcoin (BTC) $ 105,921.00 1.15% Ethereum (ETH) $ 2,418.90 2.65%

Ethereum (ETH) $ 2,418.90 2.65% Tether (USDT) $ 1.00 0.02%

Tether (USDT) $ 1.00 0.02% XRP (XRP) $ 2.18 2.38%

XRP (XRP) $ 2.18 2.38% BNB (BNB) $ 648.61 1.27%

BNB (BNB) $ 648.61 1.27% Solana (SOL) $ 148.40 3.28%

Solana (SOL) $ 148.40 3.28% USDC (USDC) $ 0.999864 0.01%

USDC (USDC) $ 0.999864 0.01% TRON (TRX) $ 0.280066 0.19%

TRON (TRX) $ 0.280066 0.19% Dogecoin (DOGE) $ 0.158531 3.56%

Dogecoin (DOGE) $ 0.158531 3.56% Lido Staked Ether (STETH) $ 2,417.48 2.68%

Lido Staked Ether (STETH) $ 2,417.48 2.68%

One of South Korea’s largest cryptocurrency exchanges, Bithumb, announced on Thursday the beta launch of Pickthumb, its public voting platform for coins vying to list on the exchange. The aim of this new platform is to strengthen the “transparency and fairness” of Bithumb’s cryptocurrency evaluation and listing process, the exchange detailed.

According to its website: "Pickthumb is a platform for screening excellent coins based on your fair evaluation … users can directly evaluate, validate and vote on cryptocurrency projects that will be listed on global cryptocurrency exchange Bithumb."

Bithumb explained that any registered users can participate, adding that members can actively give their opinions and “exert more influence” on coins to be listed on the exchange. Going forward, Bithumb says it “will try to promote a healthy cryptocurrency ecosystem that investors can believe in.”

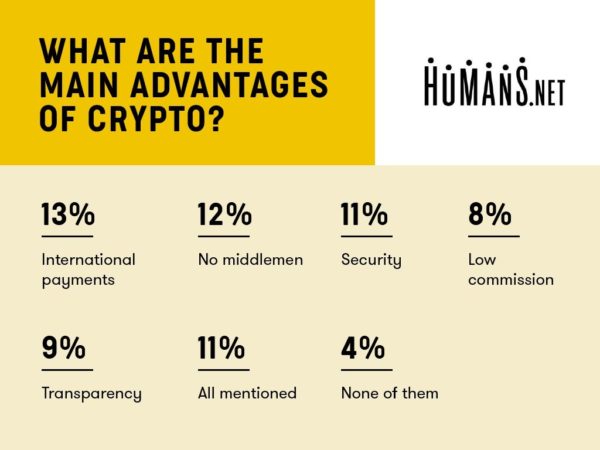

A survey of 1100 freelancers recently conducted by Humans.net, found that cryptocurrency is becoming extremely popular among the self-employed. According to the study, 38% of the 1100 people surveyed said that they have used cryptocurrency before, while 41% had never used the technology, and only 24% had never heard of it.

Some of the advantages that freelancers found in crypto were illustrated in the graphic below:

Earlier this month, Humans.net announced that they will be using blockchain technology for their freelancing platform.

Founder and CEO of Humans.net, Vlad Dobrynin, told Coinpedia that:

"We are using an advanced AI to drive the search process on the platform which will radically alter how we connect online with peers and businesses. People will get swift and accurate search results irrespective of geographical location. By leveraging decentralized networks, power is given back to users ensuring no one can use their data without their permission. In today’s world of data driven economies, this is a radical but far-reaching step."

There are many influential figures in the financial world that have expressed different opinions about Bitcoin, and the future of cryptocurrency. One of those is Bill Gates – the principal founder of Microsoft, and one of the richest individuals in the world. It’s important to note that Gates’ influence is not limited by any means to the financial or tech world, as he is considered one of the most important figures in philanthropy, as well. Specifically, he has founded the world’s largest charity, the Bill and Melinda Gates Foundation, that has over $50 billion in assets. The Foundation’s main aims are to reduce poverty and increase access to information technology. Gates himself has donated over $28 billion to the Foundation.

Flip-Flopping On Bitcoin

Gates has an immense amount of wealth of over $95 billion. Many in the cryptocurrency community feel that his negative comments about Bitcoin have more to do with the fact that he might be threatened by the fact that fiat currency – which he has plenty of – might be threatened. Others dismiss that idea, explaining that Gates could always purchase Bitcoin if he thought it was a solid investment. Of course, Gates’ influence means that his comments could affect the price.

Despite the chilling crypto winter, bitcoin-friendly Thailand remains enthusiastic and determined to hodl on.

As first reported by Nikkei Asian Review on December 4, 2018, the highly reputed Thai cryptocurrency exchange, Satang Corp. has announced plans to launch its security token offering (STO) by early 2019, and the government of Thailand fully supports it.

Satang Exchange Joins the STO Movement

Per sources close to the matter, Satang Corp., a leading cryptocurrency exchange and trading venue, will be organizing an STO for the first quarter of 2019 to raise $9.9 million to fuel its growth plans.

Satang has made it clear that the $9.9 million it’s aiming to generate through its STO event would be channeled towards the development of its e-wallet app and make it easier for clients to make payments of all kinds.

Since implementing its ICO regulation earlier in July 2018, the Thai government has not stopped in making the state a global crypto and blockchain technology heavyweight.

Blockchain-focused online payment processor NetCents Technology Inc (CNSX:NC) (OTCMKTS:NTTCF) said on Monday that it has released the first cryptocurrency processing platform based on the software as a service (SaaS) distribution model.

The Vancouver-based company said in a press release that the SaaS platform is designed to be a turnkey approach for starting or adding cryptocurrency processing to a platform or portfolio. The versatility and flexibility of the system allows easy branding, onboarding and integration, according to NetCents.

"We knew that we needed to partner with key players in the payments space and work together to bring crypto payments from a vision of the future to a reality and make it easier for consumers to spend crypto," CEO Clayton Moore said in a statement.

Last month the company struck a reseller agreement with Vancouver-based Kubera Payments for its cryptocurrency merchant gateway.

Shares of NetCents climbed C$0.01 to C$0.96 in Monday’s Canadian trading.

The G20 countries have called for the taxation of cryptocurrency, as well as its regulation to combat money laundering, Japanese news outlet Jiji.com reports Dec. 2.

According to Jiji.com, the final text of a document jointly delivered by G20 leaders calls for “a taxation system for cross-border electronic payment services.”

CEO of the company behind the cryptocurrency investment app Circle had called for “normalization at the G20 level” of the crypto industry.

Le Maire said that leaders will “have a discussion all together on the question of Bitcoin (BTC)” since “there is evidently risk of speculation.” He then concluded that France needs to “examine this with other G20 members” to see how “we can regulate Bitcoin.”

KuCoin, a Singapore-based cryptocurrency exchange, has signed a partnership with Simplex, which will allow users to buy cryptocurrency with credit and debit cards.

Israel-based payments and fraud prevention company Simplex is a payments startup with a focus on fraud prevention. In February 2016 raised USD 7 million from a number of investors, including Bitmain. In June 2018 it started a service for companies running initial coin offerings.

According to the KuCoin website, customers will now be able to buy Bitcoin, Ethereum, Litecoin, USD and EUR using their payment cards. KuCoin moved to the EOS blockchain from Ethereum shortly after the former’s launch in April, and earlier in November raised USD 20 million in funding from three different investment firms. In August, the exchange announced that it would be keeping its KCS tokens locked up for an additional year, until September 2019. The token has a market capitalisation of USD 56 million, and there are 100 million in lockup.

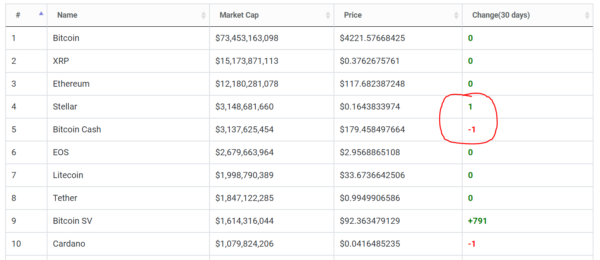

Stellar Lumens has become 4th largest cryptocurrency since last couple of hours. Stellar Lumens overtook Bitcoin Cash. Stellar Lumens facilitates payments, and is one of the few cryptocurrencies that is gaining real adoption. That’s why Stellar Lumens really deserves to be in the top 4 cryptocurrencies, and this is in line with the 5 cryptocurrency predictions for 2019.

As a reminder Stellar Lumens faciliates payments by making it much easier to handle mobile payments, much cheaper micro payments and much more accessible to the large group of unbanked in the world.

Below is the table of the 10 largest cryptocurrencies, and their change in market cap.

This relative market cap change is also reflected in the relative price strength that Stellar Lumens exhibits.

A Chinese cryptocurrency giant plans to introduce a so-called “digital peso” next year to serve not only overseas Filipino workers (OFWs) but also Chinese nationals working here in the Philippines.

Wang said the digital peso was aimed at reducing international remittance fees, hence would benefit OFWs.

“In China, they have electronic payments systems like Alipay and WeChat Pay, so transfer of funds is very easy. We understand in the Philippines, many Filipino citizens don’t have a bank account, and when they transfer funds from one country to another or from one place to another, there’s always a high remittance fee incurred, so we are working towards reducing that kind of cost for the average Filipino citizen,” Wang explained.

AirTM.com, a P2P exchange platform and digital wallet for the developing world, has launched AirdropVenezuela.org a campaign to send $10 equivalent of cryptocurrency and US dollars directly to the AirTM accounts of 100,000 I.D.-verified Venezuelans. The goal of AirdropVenezuela is to raise a minimum of USD $1,000,000 to help Venezuelans suffering from the world’s worst hyperinflation to buy food, medicine, and other necessities.

“Cryptocurrency is a revolution of financial freedom and opportunity, and AirTM is proud to make cryptocurrency accessible and useful to the people who need it most,” commented Josh Kliot AirTM Co-Founder and Chief Product Officer. “With cryptocurrency and AirTM, it’s possible to make direct donations to people in need that are accessible as local money to anyone in the world at free market exchange rates.”

AirTM operates a blockchain and bank-connected digital wallet and peer-to-peer exchange platform (the AirPlatform) that provides globally-connected financial services to consumers and businesses in the developing world. AirTM helps consumers and businesses in countries with devaluing currencies, hyperinflation, and limited banking systems to exchange local money for cryptocurrencies (including fiat-pegged cryptocurrencies such as AirUSD), at the free market rate determined by exchanges on its peer-to-peer platform.

US-based Silvergate Bank has transformed itself in recent years from a typical business bank to one of the financial institutions of choice for digital currency companies, reports Sarah de Crescenzo for Xconomy (FinTech Futures’ sister publication).

Now the cryptocurrency-friendly bank, which is headquartered in La Jolla, California, is preparing to go public. It has set a $50 million price target, according to documents filed with securities regulators.

The bank has applied for a New York Stock Exchange listing under the stock symbol “SI”. Silvergate didn’t provide much detail on how it planned to use the proceeds, saying simply that the money would go to fund “organic growth and for general corporate purposes”. That could include paying off long-term debt and making acquisitions, the bank says, but also notes that it doesn’t have any current acquisition plans.

As of 30 September, Silvergate had 483 digital currency customers, which had $1.7 billion in non-interest bearing deposits with the bank. A year ago, it had 114 such customers and about $609 million in such deposits. The bank reported net income of $14.3 million as of 30 September. At the same time last year, it reported $5.7 million.

“Our ability to address these market dynamics over the past five years has provided us with a first-mover advantage within the digital currency industry that is the cornerstone of our leadership position today,” Silvergate said in its prospectus.

New York-based Goldman Sachs announced it would open a trading desk for cryptocurrencies, but later reportedly scrapped the plan.

Silvergate Bank is owned by holding company Silvergate Capital.

Invault, a Shanghai-based cryptocurrency custodian service, recently launched after Hong Kong imposed new regulations on cryptocurrency exchange platforms and fund managers, requiring them to protect and safeguard their clients’ virtual assets, according to South China Morning Post’s on November 25, 2018.

Custodians of Digital Assets Will Become the Norm

InVault protects cryptocurrency assets by holding onto the client’s private key and storing it in a physical vault. In the past, although private keys are relatively hard to crack, they have often been stolen or hacked. Kenneth Xu, the founder, and chief executive officer of Invault believes that, as the cryptocurrency industry progresses, licensed trustees or custodians of digital assets will become a global norm.

“We believe that globally, custodians for cryptocurrency assets will be regulated and operated under a trust license,” said Xu in an interview with the South China Morning Post.

It’s not a surprise if the cryptocurrency industry moves in this trajectory. In the past, cryptocurrency exchanges suffered from security issues and hacking attempts. In 2018, South Korean exchange Coincheck incurred losses of $533 million as hackers stole 523 million NEM tokens. Italy-based Bitgrail lost $195 million after hackers took 17 million Nano tokens, and Bithumb, another South Korean cryptocurrency exchange lost $31 million in 11 different cryptocurrencies.

Sporting, a Portuguese football team announced it was planning to launch an Initial Coin Offering and its own cryptocurrency as an alternative method to fund the club.

According to the report, Sporting is mulling launching its own digital currency through an Initial Coin Offering (ICO). This was one of the options the football team set on top of the table as an alternative way of financing and taking advantage of this new world of digital coins. The country’s financial markets regulator already advised the entities involved in the launch of ICOs to ask for legal clarification from the competent authorities before any move.

Francisco Salgado Zenha, the team’s Vice President told the news agency:

“We’re in meetings to discuss this topic. We are looking closely at an ICO. We believe there is a great potential for the Sporting brand if we go ahead with this option. But it is still an option and we have nothing concrete yet.“

Bitex has officially launched as the United Arab Emirates’ (UAE) newest digital asset exchange. The Dubai-based trading platform will initially support bitcoin core, bitcoin cash, ethereum and litecoin. Bitex also announced the launch of a cryptocurrency wallet that offers an additional cash deposit service, according to media reports.

Monark Modi, chief executive officer of Bitex UAE, said the exchange will provide multiple payment options including bank transfer and credit or debit cards. The cash deposit service allows users to schedule a cash pickup, with funds immediately deposited in their accounts and available for trading within 24 hours, he explained.

Modi stated:

"UAE residents have been calling out for more options to securely buy and sell digital currencies … while residents have been able to use international trading platforms for some time, having access to a local exchange is far more convenient. Trading via a UAE-based company allows customers to easily deposit local currency rather than first having to exchange it for a more widely-accepted currency".

The Indian government has reportedly filed an affidavit with the country’s supreme court detailing its progress on cryptocurrency regulations. “Serious efforts are going on” to prepare the draft crypto bill and report, the government explained. The two are expected to be discussed by the inter-ministerial committee by next month.

The Indian supreme court has been trying to hear the petitions against the crypto banking ban by the central bank, the Reserve Bank of India (RBI).

“A finance ministry panel set up in November 2017 could be ready with draft regulations next month,” the news outlet wrote. It proceeded to publish the following excerpt from the counter-affidavit:

"…currently, serious efforts are going on for preparation of the draft report and the draft bill on virtual currencies, use of distributed ledger technology in (the) financial system and framework for digital currency in India."

According to the counter-affidavit, “The next two meetings of the Garg panel, to be held next month and in January 2019, will deliberate the draft report, and the provisions of the draft bill on virtual currencies,” the news outlet conveyed.

If you’re a crypto enthusiast and adventurer with no plans for April 2019, perhaps you can merge your two passions and attend the first Blockchain and Cryptocurrency Conference to be held in North Korea.

In a press release published on the official website of the communist country, the Korean friendship association announced that preparations are underway to open Korea´s doors to investors and crypto fans from around the world to visit Pyongyang and share their experiences.

The entrance fee is 3300 euros per person and includes flights China – North Korea – China, accommodation, transportation, and food. The event will begin on April 18, 2019, and end on April 25, 2019. But, be careful: No journalists or distribution of “any mass printed propaganda or digital/printed material against the dignity of the Republic” is permitted. Also, people from South Korea, Japan and Israel cannot attend the event either.

Americans, however “are welcomed to apply”

The central bank of Singapore has finalized the country’s new regulatory framework for payment services, which now includes cryptocurrency. Crypto payment service providers, which fall outside of the current regulatory framework, will need to be licensed under the new regime.

Regulating Crypto Payment Services

The Monetary Authority of Singapore (MAS), the country’s central bank, announced on Monday that it has finalized the new regulatory framework for payment services. The Payment Services Bill “will provide a more conducive environment for innovation in payment services, whilst ensuring that risks across the payments value chain are mitigated,” the central bank explained. The bill was submitted to parliament by Education Minister and MAS board member Ong Ye Kung, the Straits Times reported.

"The MAS will allow up to 12 months for payment service providers to comply with the changes after the new Act is in force. Those who provide digital payment tokens will be given six months to comply."

Ran Neu-Ner, the host of CNBC's "Crypto Trader" show, once one of XRP's harshest critics, now says: "At this rate XRP will be in the number 1 spot by Friday."

On Monday (19 November 2018), probably the worst day for the crypto market this year with Bitcoin (below $5000 for the first time since October 2017), Ether, and Bitcoin Cash losing around 14%, 14%, and 43% respectively (in the past 24-hour period) and the rest of the major cryptocurrencies (excluding stablecoins such as Tether) not doing much better, there was much despair and gloom to be found.

Ripple is trading around $0.48 almost the same as day before

Ran, who is the host of CNBC Africa's "Crypto Trader" show, used to be one of XRP's harshest critics. On 17 May 2018, while appearing as a guest on CNBC's "Fast Money" show, Ran recommended selling XRP. Here is how he expressed his opinion about XRP:

"I'm throwing it in the garbage... I can't find a use case for the token... I'm out."

Switzerland’s main stock exchange introduced Amun Crypto ETP, the first world's first ETP (Exchange Traded Product) that will track prices for multiple virtual currencies. The instrument designed to follow the movements of the five largest coin will start trading this week on the Six exchange in Zurich.

The investments in ETP will be divided between Bitcoin (50%), Ripple's XRP (25.4%), Ethereum (16.7%), Bitcoin Cash (5.2%) and Litecoin (3). According to Amun's co-founder and chief executive Hany Rashwan, the investment vehicle adheres to the same strict regulatory standards as all the traditional Exchange Traded Products.

“The Amun ETP will give institutional investors that are restricted to investing only in securities or do not want to set up custody for digital assets exposure to cryptocurrencies. It will also provide access for retail investors that currently have no access to crypto exchanges due to local regulatory impediments,” he commented.

Vancouver, British Columbia--(Newsfile Corp. - November 19, 2018) - GLOBAL BLOCKCHAIN MINING CORP. (CSE: FORK) (OTC: GBCHF) ('FORK' or the 'Company') announces that in response to an overwhelming volume of investor inquiry about the Company's current developments and revised business strategies, it has created an open forum to answer questions and help clarify the Company's initiatives.

FORK's new forum can be found at the following URL: https://www.reddit.com/r/ForkCSE. The Company's presence on Reddit will complement its existing channels that include email support, and phone communication channels.

President and CEO of the Company Shidan Gouran commented, 'We care about what our shareholders have to say, and we believe that by offering an open public forum in which their questions can be answered, we will deliver even more value to them. Our Company has undergone a number of key changes over the past couple of months, and we know that there are many questions about these changes. For that reason, we have created an open forum on Reddit to clarify investor enquiries to the benefit of the whole community, and we look forward to answering questions about FORK as they come up.'

Cryptaur has signed a partnership agreement with renowned companies ProximaX and NEM following the first public demonstration of their new gaming platform, X-game, in Dubai.

Cryptaur, a decentralized ecosystem for P2P services, has signed a partnership with ProximaX and NEM following the first public demonstration of X-game at GITEX Future Stars 2018.

ProximaX will be used within X-game to host the ePassports of all users and to store the data of game characters and their elements. NEM, on the other hand, is used as a decentralized registry for Cryptaur users.

The agreement was signed personally by Lon Wong, First President of NEM and Founder of ProximaX. For Cryptaur, the partnership comes at a time of exciting developments.

Dimitri Buriak, CEO of Cryptaur

‘ProximaX will be an important element in ensuring user confidence in the Cryptaur platform. In the near future, we plan to implement the storage of personal documents of our participants based on ProximaX, reliably protecting them with modern encryption algorithms.’The new device simply needs to be connected to a power source and wifi in order to operate.

Coinbase Ventures-backed Coinmine has released a new, Xbox-like at-home crypto miner, the “Coinmine One.” for $799, the Coinmine One can mine Ethereum, Ethereum Classic, Monero, and Zcash, although not Bitcoin–at least, not yet. Coinmine also plans to eventually add support for Grin, Dfinity, Filecoin, and Bitcoin Lightning.

Farbood Nivi, cofounder and CEO of Coinmine, told about how his company’s product is supporting the decentralized spirit of the cryptosphere. “Crypto is about decentralizing information and money with decentralized computing,” he explained to Business Insider. “The more you can support the decentralization, the more people can support the decentralizing power, the more secure, powerful, reliable and valuable crypto becomes.”

The B2BX is among the first cryptocurrency exchanges to be completely regulated in Europe.

B2BX Exchange, a professional digital asset trading platform, has received approval for a regulatory license from the Estonian Financial Intelligence Unit (FIU), the company announced on Monday.

B2BX Exchange, part of the B2Broker Group, provides access to institutional level liquidity. It is a spot trading platform that gives its customers the ability to trade major cryptocurrencies such as Bitcoin, Ethereum, NEM, Litecoin, Ripple, NEO, Monero and Dash.

B2BX supports the five major stablecoins – USDT, USDC, GUSD, PAX, and TUSD. Through the license, which will come into effect shortly, the exchange believes it can extend its cryptocurrency services, as well as introduce crypto-to-fiat products. In addition, clients of the exchange will have access to increase daily limits for automatic deposit and withdrawals.

Hong Kong start-up AssetOnChain Technology launched the first global blockchain-based diamond trading platform.

Rico Tang, co-founder and chief executive of AssetOnChain Technology, said the price and the information of the diamonds was not transparent. Tang hopes the platform will be widely used.

The minimum trading quantity is 1 carat, equivalent to US$15,000 (HK$117,000).

Comparison site Moneybrain has today announced the launch of a new asset-backed utility token.

The BiPS Token, created in collaboration with JustUs, Moneybrain’s peer-to-peer sister company, is understood to be the first asset-backed token created and minted by an Financial Conduct Authority-regulated authority.

The token, which is set to go on public sale next year, will enable members of the BiPS community to buy tokens, instead of shares, as digital currency which can be used globally as payment or exchange, with all trades being available on the public blockchain ledger.

Once on public sale, 95 per cent of the public sale token proceeds raised will be used to acquire property or other physical assets.

Lee Birkett, Moneybrain chief executive, said the company’s aim was to instil trust in the crypto world by creating an underlying value in the BiPS token.

“It would have been easy to say we’re not doing this in the UK and opt for an offshore designated area,” he said. “But we felt it was really important that the work we have done evolves onto the blockchain and is recognised as United Kingdom work.”

KUALA LUMPUR: Jakarta Futures Exchange (JFX) is teaming up with Kinesis Money and Allocated Bullion Exchange (ABX) to develop an Indonesian based and regulated blockchain exchange.

JFX, which is Indonesia's futures and derivatives exchange group, had on Tuesday expanded the MoU with Kinesis Money and ABX to develop a blockchain exchange using Kinesis technology.

ABX, the world's leading electronic institutional exchange for physical precious metals, has been working with JFX to expand gold investment opportunities in Indonesia.

The CEO of Kinesis and ABX, Thomas Coughlin said their blockchain network creates a complete monetary system which enables real, physical assets to be transacted and exchanged digitally, at speed and at low cost.

“We believe that the integration of physical precious metals and distributed ledger technology offers tremendous value to the Indonesian market, with its dual interest in gold and in blockchain. We look forward to continuing our partnership with JFX to bring this to fruition."

Current statistics reveal that Bitcoin ATMs around the globe are about to reach 4,000. Though not as widespread as mainstream ATMs, BTC ATMs seem to experience astronomical growth. In November, the number of such machines worldwide is expected to cross the 4,000 milestone.

Bitcoin ATMs almost at 4,000

Over time, Bitcoin ATMs have become increasingly popular across the globe. According to Cointatmradar, a platform that monitors cryptocurrency ATMs around the world, the current number of BTC ATMs stands at 3,991, almost reaching the 4,000 milestone.

The United States continues to retain its top slot among other countries across the globe, with 2,219 ATMs spread across the country. Its North American counterpart, Canada, ranks second with 600 BTC ATMs. Other countries, including Indonesia, Saudi Arabia, Iceland, Thailand, Cyprus, Philippines, and Germany, have one Bitcoin ATM each in their countries.

The most renowned and world’s largest crypto exchange by trading volume, Binance is launching its own analysis and research division. Binance is calling this new analysis wing as Binance Research. Moreover, the research division will focus on creating industry grade analysis reports. The crypto exchange launched the platform on November 8, 2018, for industry analysis.

Binance announced the launch of their new analysis and research division on their official blog. It stated: “Fellow Binancians, Binance is happy to announce the official launch of our new analysis division, Binance Research.”

Binance Research already has two reports online: LOOM and GoChain. LOOM is one of many scaling solutions for the Ethereum blockchain. GoChain is an independent blockchain which is interoperable with Ethereum and boasts some improvements but has yet to create the massive steamrolling network effect that would be necessary to truly compete with Ethereum in a realistic way.

Kaleido, a ConsenSys company, in collaboration with Amazon Web Services, is helping enterprises break through the proof-of-concept stage to live production blockchain networks with the announcement of its next major step forward.

The newly launched Kaleido Marketplace extends its Blockchain Business Cloud to become the first full-stack enterprise platform available today. The new marketplace includes trusted tools and services from Kaleido, AWS, and members of the new partnership program, all offered as plug-and-play.

“We’ve seen successful patterns of deployment as enterprise networks go into production and we’ve baked these best practices into the Kaleido Marketplace services, to help radically simplify the adoption of blockchain and eliminate some of the specialized blockchain expertise needed,” said Kaleido Founder and COO, Sophia Lopez.

Spanish banking group Banco Bilbao Vizcaya Argentaria (BBVA) has successfully completed a $150 million syndicated loan transaction using blockchain technology.

The syndicated loan transaction was conducted on a private blockchain network through which six entities participated in the process. BBVA granted the loan alongside Japanese bank MUFG and French banking group BNP Paribas to Red Electrica, a corporation which operates Spain’s national electricity grid. UK-based law firms Linklaters and Herbert Smith Freehill also participated in the transaction.

“This transaction is part of the our company’s initiative to push digital transformation and innovation as levers for growth and efficiency,” Quirós said.

The Malta-based companies Praestentia CleanTech and BDXAlliance - in partnership with Paragon Europe - are embracing the progressive stance of 'Blockchain Island,' Malta. Together, they're on a mission to save the world.

Few organisations are positioned to achieve this goal. The marriage of blockchain and sustainability, however, is one of the ways new technology is solving traditional problems.

Dr. Anton Theuma and Edwin Ward, CEO and Chairman respectively of Praestentia CleanTech said, 'Praestentia CleanTech was launched in October 2018 to fight to save the world and create a B2B and B2C cleantech marketplace, marketing directly to source at low cost. For many years we've been on a mission to leave the planet better than we found it. Our desire has always been to go global with our work. Now, partnering with BDXAlliance, we can create the world's largest community who also want to save the world. Long-term, our community will have access to debit and credit cards that provide reward points. Our Community Members will have banking-style services backed by a Membership and Loyalty Program that will be the most flexible in the world. The shared projects will have shared benefits across them. All our organisations think globally and want to save the world, with a strategy that combines blockchain technology with sustainability in smart ways to make a difference’.

Mindex, GMEX Group and Hybrid Stock Exchange Corporation Limited (HYBSE) have joined forces to unleash the “first” blockchain securities exchange in Mauritius.

As reported in June, the UK government’s Department for International Trade (DIT) was supporting GMEX in the creation of a new exchange trading ecosystem in the Indian Ocean island nation.

In the latest development, the HYBSE International Marketplace; a joint venture between Mindex, GMEX and HYBSE; will “integrate blockchain solutions and technology with traditional financial industries providing a complete and governed ecosystem that digitalises assets onto the blockchain”.

According to the firms, SMEs will be able to use the marketplace for an initial blockshare offering (IBO); a time-limited offer to purchase cryptonised equities and other cryptonised instruments, such as blockshares, from businesses registered on the marketplace at “special discounted rates”.

The research arm of major Hong Kong-based cryptocurrency derivatives platform BitMEX announced it had launched a network monitoring tool for Bitcoin (BTC) and Bitcoin Cash (BCH) in a blog post Nov. 5.

ForkMonitor is connected to “several” nodes on both the Bitcoin and Bitcoin Cash networks.

By press time, BitMEX is the second largest cryptocurrency exchange globally by reported daily trade volumes. However, as CoinMarketCap notes, since BitMEX is a derivatives market, its trade data is “excluded from the price and volume averages of Bitcoin” on the site.

Caracas, Venezuela — November 2, 2018 — Dash, the leading cryptocurrency for payments and e-commerce, has announced the launch of Dash Text, a Venezuela-based company providing SMS-based transactions for Dash. This now provides a completely new way for users to acquire, store, and spend their Dash, while solving for one of the major barriers to entry in the cryptocurrency space — the need for a smartphone and access to the Internet.

Bradley Zastrow, Global Head of Business Development at Dash Core, said:

Venezuelans living abroad send an estimated $2 billion USD back home in remittances. This process often takes too long and costs too much, making it a huge pain point for many users. With Dash Text, we are providing real solutions that address real problems. People need easy and cheap ways to send money home, and we’ve done it in a way that expands the Dash ecosystem to those without smartphones! Dash Text offers the perfect solution to ensure that everyone can become part of the Dash family, regardless of what phone people own.”

Hong and Shanghai Banking Corp (HSBC) India and ING Bank Belgium have jointly executed a trade transaction using blockchain enabling cross border payment from a US-based company to India's Reliance Industries in a totally digital form.

"(The transaction) allowed a digital transfer of the title of goods from the seller to the buyer in the underlying trade. It further enabled the underlying trade to be fully digitised.

Eight banks namely, HSBC, ING, Bangkok Bank, BNP Paribas, CTBC Holding, NatWest, SEB and Standard Chartered together with US-based enterprise blockchain software firm R3 are working on an open source-based system with plans to expand the network and drive adoption across the industry.

Srikanth Venkatachari, joint CFO at Reliance Industries said the use of blockchain offers potential to reduce the timelines involved in exchange of export documentation from the extant 7 to 10 days to less than a day.

South Korean crypto exchange Bithumb has teamed up with crowdfunding platform seriesOne to launch a compliant security token exchange in the U.S.

According to a blog post published by seriesOne on November 1, 2018, the two companies will launch “a [regulatory] compliant marketplace to trade Security Tokens, subject to receipt of SEC, FINRA and other applicable approvals.” Furthermore, Bithumb will aid seriesOne’s expansion into South Korea by investing in the regional arm and helping with development and marketing.

The CEO of Bithumb, Back Young Heo, said:

“We are very excited about joining with seriesOne. We are not only impressed by the mix of talent between investment banking, compliance, and technology of the seriesOne team but also with their deep understanding of US securities regulations and how they apply to token offerings.”

Blockchain has the potential to provide a universal distributed system that can be used by several retail banks to drive efficiency and bring systems together allowing improved quality of service, opening up options for new products and services, according to GlobalData.

The predictions comes from independent data and analytics company GlobalData , whose Retail Banking Analyst, Sean Harrison, notes, “The need of the hour [for financial services leaders] is to focus on domains where the legal, regulatory, or political environments hinder the establishment of a central controlling authority, crucial for the commercial adoption of Blockchain.”

Banks globally have been testing the blockchain technology for some time now, points the group – either to implement in their core banking system or integrate into their traditional systems.

BlackRock, the world’s largest asset management firm, will not be offering a cryptocurrency exchange traded fund (ETF) until the markets are further legitimized. Despite the asset management firm’s CEO, Larry Fink, being bullish on blockchain technology, he still has reservations regarding cryptocurrency.

“I wouldn’t say never — when it’s legitimate, yes,” Fink said at the New York Times Dealbook conference, as reported by CNBC. “It will ultimately have to be backed by a government. I don’t sense that any government will allow that unless they have a sense of where that money’s going.”

BlackRock is a financial planning and investment management firm that currently has $6.28 trillion in assets under management, including equity, real estate, fixed income, and cash management.

The new card will allow users to make payments anywhere in the world

This Wednesday, Chain2Pay – an Subsidiary of blockchain organization MinexSystems – reported that it has introduced a cryptographic Debit card.

The company is making the cards for MinexPay, another MinexSystems subsidiary and a firm that is trying to develop payment solutions in the cryptocurrency sphere.

According to MinexPay, the cards can be used anywhere in the world, even in countries where regulators have banned cryptocurrencies.

In the massively competitive crypto market with more exchanges emerging all over the world, Bittrex is appealing to new projects to bring their tokens to their market without having to be hit by extended delays.

Bittrex International launches a digital trading platform for qualified international customers.

The new platform was previously branded Bittrex Malta, and it will speed up the listing process for tokens while streamlining the approval process.

“Bittrex International’s more efficient token listing process, combined with our reliable, secure and advanced trading platform technology, will make it easy to quickly feature the newest, most innovative blockchain projects for our international partners and customers,” CEO Bill Shihara said.

Shihara continued and explained, “And, because we believe it’s more important for token teams to invest their time and money in technology and business development, Bittrex International — just like Bittrex.com — will not charge a token listing fee.”

Bitstamp, one of the Top 30 cryptographic Exchanges on the planet by day by day exchanging volume, was Aquired by Belgium-based organization NXMH for an undisclosed amount in real money, published by Reuters on October 29, 2018.

Another Crypto Exchange Acquired

With this successful buy, NXMH now apparently has 80 percent stake in Bitstamp, while CEO Nejc Kodric holds a 10 percent proprietorship at this stage and will keep on working with this job at Bitstamp

Different partners of the trade, including prime supporter Damian Marlak and Pantera capital, have now sold piece of their stake to NXMH.

Helped to establish in 2011 by Kodric and Merlak, Bitstamp as of now has more than three million enlisted clients, and is the biggest cryptographic Exchange in the European Union , every day exchanging volume of over $100 million in different digital forms of money.

As indicated by Kodric, the Exchange had only one server, two or three PCs, and a thousand euros in capital at commencement, however it is currently valued at more than $60 million.

US-based startup Ripple has contracted Google's RCS messaging or rich communications services expert Amir Sarhangi as a VP, Reuters published on saturday. Sarhangi will control the improvement of Ripple's blockchain-based framework for global payments network known as RippleNet. He turned out to be the second new VP at Ripple in the previous couple of months after the Californian firm selected ex-Facebook official Kahina Van Dyke as a senior VP of business and corporate advancement in July.

As Ripple’s vice president of product, Sarhangi oversees the development of RippleNet , a service that uses blockchain technology to help financial institutions like banks to process payments. Earlier this month, global Spanish bank Santander claimed that it had successfully integrated RippleNet into its international cross-border mobile application One Pay FX. Using the distributed ledger technology (DLT) transaction settlement service, however it is not connected with the utilization of Ripple cryptocurrency, XRP, which is the third-largest virtual coin by market capitalization.

Hitachi through Hitachi Payment Services Pvt. Ltd. ("Hitachi Payments"), a wholly-owned subsidiary based in India of Hitachi is entering into a joint venture with State Bank of India, the nation's biggest bank for the establishment of a state-of-the-art card acceptance and future ready digital payments platform for India.

Hitachi Payments will invest in SBI Payment Services for a 26% stake, a Hitachi press release confirmed, It is creating strong bonds in its relationship with the state-owned bank as its technology provider for card and digital payments which exists since 2011.

“Hitachi will provide wide range of services contributing to “Digital India” by creating innovative solutions with ‘Lumada’,” Hitachi said. “With this joint-venture, Hitachi will accelerate digitalization of financial services in India by linking up digital payments platform to state-of-the-art digital technologies of “Lumada”, and also will provide solutions for mass transit sector and e-commerce businesses.”

A business bank in the Czech Republic is currently offering benefits that will allow conventional money tools to cryptographic currency clients. Expobank CZ says its clients will have the capacity to exchange crypto forms of money, put resources into new businesses, and purchase valuable metals.

Expobank CZ claims it is the primary bank in Europe to offer account holders the chance to perform crypto-related exchanges. The new administration called Neo, depends on the bank's online front Expobanking. It gives clients full power over their monetary exercises, including cryptographic forms of money, Prague Express told.

The group at NetCents HQ have published their monthly report on their site. In October report, the group tells their customers, fans and the crypto network, on the real progress they have made in the previous month. The main being that designs are in progress of incorporating SoftPoint: the primary completely coordinated friendliness administration framework that has practical experience in activity, installments and controls. Netcents has added three more crypto currency viz XVG,TRX,HZ in their payment system

Netcents is propelling a digital currency card into the Canadian and European markets. The NetCents Card will have the capacity to be used at anyplace, at more than 40 million traders around the world, where Visa or MasterCard are acknowledged. Unlike other crypto cards in the market, NetCents cardholders won't need to pre-load cryptographic money onto their card, as the card will be specifically integrated with their NetCents wallet.

Necents additionally entered in a five-year ISO Reseller Agreement with Bleu Tech Enterprises, Inc. ("Bleu™"). Through this agreement, the NetCents digital money handling process will be coordinated into the Bleu Point of Sale (POS) terminals. When the work will be finished, dealers who utilize Bleu POS will have the capacity to acknowledge Bitcoin, Litecoin, Ether, and other cryptos as payment for their retail clients.

COBINHOOD , The next-generation cryptocurrency service platform and zero-fee exchange, today announced the launch of Margin Trading on its platform. Starting October 19, COBINHOOD users, from the novice to the experienced, are able to maximize their trading power and tap into unused funds for greater value.

Margin trading is available for BTC/USDT, ETH/USDT, ETH/BTC, and COB/ETH.

COBINHOOD's Margin Trading functions provide both novice and experienced traders the opportunity to develop their skillset on a safe and reliable platform. Through expert tutorials, COBINHOOD helps elevate traders to expert levels by increasing their knowledge about cryptocurrency and blockchain technology in a digestible, yet informative way.

For more information, please visit https://cobinhood.com.

The ATM is installed by a domestic bitcoin company Unocoin, which claims that its ATM has nothing to do with India's banking system and, hence, does not violate any RBI norms.

“We have completed our trails on Thursday afternoon. We have completed all the procedures. Either it will go live Saturday morning or on Monday morning,” said Sathvik Vishwanath, CEO and Founder, Unocoin.

The ATM, set up by cryptocurrency startup Unocoin calls for a minimum amount for deposit and withdrawal of at least Rs 1,000 and must be in multiples of Rs 500. The ATM is located at the Kemp Fort Mall.

The company is hopeful of getting at least 50 transactions on the first day of going live.The company is also planning two more such ATMs in Mumbai and Delhi.

Accenture and Digital Ventures have co-developed and launched a blockchain solution to allow companies to buy and sell goods, make and receive payments, and obtain financing.

The companies claim the solution uses the world’s first integrated procure-to-pay solution on the Corda platform from software company R3.

The solution was created with SCG, a business conglomerate in the region, using design DevOps principles, along with microservices and cloud technologies. Digital Ventures’ blockchain solution for procure-to-pay, also known as “B2P”, is already in production use, handling transactions with selected SCG suppliers.

SCG says the new platform is aimed at improving transparency for all parties across the procurement supply chain process, while minimising human errors and integrating purchase orders and invoices between organisations without the need for reconciliations and adjustments.

According to the company’s pitch, this platform can reduce invoice financing time and prevent fraud – made possible by less physical billing and the integration of suppliers into Thailand’s e-tax invoice program, freeing up time to perform other value-added activities.

The platform’s design and implementation were completed in five months, overcoming a series of technical challenges, including integrating multiple systems for purchase orders, goods receipts, invoices and payments.

Blockchain is a major focus for ICT leaders this GITEX Technology Week, with the announcement of a number of new projects and services based on the distributed ledger.

Saudi Telecom Company (STC) launched its new blockchain-as-a-service offering, which will help companies in Saudi to test blockchain, while Abu Dhabi Smart Solutions and Services Authority (ADSSSA) has announced its blockchain strategy.

Talal AlBakr, Vice President of Cloud Services at STC Solutions says: "Adding blockchain to STC's Cloud Marketplace allows customers to start a private blockchain network with a click of a button. This service is a unique innovative offering on our marketplace that helps organizations to rapidly build and deploy blockchain applications."

Rami Maalouf, solutions practice lead MENA, ConsenSys, adds: "There's lots of demand from large enterprises + SMBs trying to understand how they can use blockchain for their own business purposes, whether it is optimising their own operations, or improving the provenance of some of their processes with external stakeholders - this is a starting point for them to have their technical teams start experimenting with use cases on top of a private blockchain."

Wisekey has launched the Universal Decentralised Identification (UID) system to enable the creation of digital IDs across a distributed ledger.

The UID system is based on WISeKey’s CertifyID BlockChain platform, which operates via a mobile app called WISeID. WISeID secures the user’s data with a combination of facial recognition, and password or pattern authentication.

WISeKey announced its compliance with the United Nations’ ID2020 program, an initiative aimed at extending official identity systems to everyone in the world, with an estimated 1.3 billion people currently thought to be undocumented.

The UN’s refugee agency has advocated biometric technology as a means of identifying individuals lacking official documentation, a stance that offers validation to WISeKey’s approach to apply contemporary mobile biometrics technology.

Binance The Major Cryptocurrency exchange has burned again its cryptocoin BNB and that too in millions, around 1.643 million BNB has been burned worth approx 16 million USD. BNB saw 8 % spike after this news and touched $ 10.4 but currently is trading below $ 10. This was the 5th Quarterly burn of BNB.

Binance reported that it was in accordance with BNB whitepaper in which 20% of the profit of Binance is to be allocated to burn BNB after buyback at market rates and that this burn was as usual successful like others.

if 20% profit was allocated to buyback than we can estimate 80 million profit for exchange which is quite a good amount in this bear market.

US-SEC has come up again heavy on SCAM ICOs, this time on an ICO claiming that it has received approval from Securities and Exchange Commission.

SEC in its recent press release informed that it has obtained an emergency court order halting a planned initial coin offering (ICO), which backers falsely claimed was approved by the SEC. The order also halts ongoing pre-ICO sales by the company, Blockvest LLC and its founder, Reginald Buddy Ringgold, III. An SEC complaint unsealed yesterday alleges that Blockvest falsely claimed its ICO and its affiliates received regulatory approval from various agencies, including the SEC. According to the SEC's complaint, Blockvest and Ringgold, who also goes by the name Rasool Abdul Rahim El, were using the SEC seal without permission, a violation of federal law, and falsely claiming their crypto fund was "licensed and regulated." The complaint also alleges Ringgold promoted the ICO with a fake agency he created called the "Blockchain Exchange Commission," using a graphic similar to the SEC's seal and the same address as SEC headquarters.

The alleged ICO was using SEC seal, NFA seal and other regulatory agencies seals, and was still using NFA seal after they issued cease-and-desist letter to stop using their seal. An U.S. District Court for the Southern District of California has issued orders to freeze assets of Blockvest LLC .

Yobit is Going to Pump a coin today exactly after 9 Hours and 30 Minutes and not one or two time but exactly 10 Times with 10 BTC Volume . While The coin being pumped is unknown and will only be known when it starts , But since volume in Terms of BTC is not that much great in Yobit and pumping with 10 BTC Volume within half an hour period suggests that it might be a coin within top 20 traded coins in Yobit while its purely a speculation yet.

According to Yobit it will only be one coin whose lucky today. So all yobiters raise sell orders on all your coins and might be some of yobiters can just got lucky.

yobit.net/en/pump/timerDisclaimer-We are not in support of any Pump scheme or related mechanism.

NNS Mainnet has been launched on 9th October 2018, 10:00 am (GMT+8).

Now users can Bid/Buy on .NEO domain , which can be used to create custom wallet addresses, email addresses, smart contract hashes etc.

There is also a two week domain name mining activity which will run between Oct. 9th-23rd 2018 (GMT+8).

What is domain name mining?

- After the user wins a domain name on the NNS Mainnet, the domain winner will be rewarded with an amount of NNC in proportion to the GAS they spend winning the domain. The specific NNC reward policy is as follows:

- Domain name winners will be rewarded with 70 NNC for each 1 GAS they spend if the domain auction start time is between Oct. 9th-16th 2018 (GMT+8).

- Domain name winners will be rewarded with 50 NNC for each 1 GAS they spend if the domain auction start time is between Oct. 16th-23rd 2018 (GMT+8).

- The amount of NNC that will be awarded in the domain name mining activity will be no more than 100 million NNC (10% of NNC total supply). If there is any NNC left, the leftover NNC will be locked up.

- All the NNC reward will be delivered after the domain name mining is closed.

go to wallet.nel.group to Bid on a .NEO domain. Price varies from 0.1 CGAS to 100 CGAS as bidders are bidding due to appeal of Domain names just like a normal .COM domain name.

Bithumb is going to launch its own DEX and way before than Binance's DEX's launch in 2019, and at a fast speed Bithumb is going to launch decentralized exchange (DEX) by end of this month.

A decentralized exchange gives user ability to own their funds and trade as they need without worrying about hacking or some evils related with an exchange. A decentralized exchange offers a relatively slow speed of trading but has excellent security. Due to regulatory troubles DEX is a better way to deal in currencies since it works on concept of P2P trades. with launch of DEX by big names liquidity in DEX markets is going to rise high surely.

Taobao, popular Chinese e-commerce site and a subsidiary of Alibaba Group has decided to ban all services on listing or related to Crypto currency and ICO . They have updated their policy to the same regard.

Crypto currency Mining and related services and consultations are already in ban by site and this development put Alibaba group in line with other major companies like Google,Facebook to ban crypto ads. Company has said this to come into force following the law of land i.e. China . which is not in favour of Crypto currency.